Global Fuel Card

Save an average of 1000$ per truck, When you use the Global Fuel Card

Get StartedSimple Truck ELD

Keep your trucking company operations legal, saving you time and the costs of expensive fines

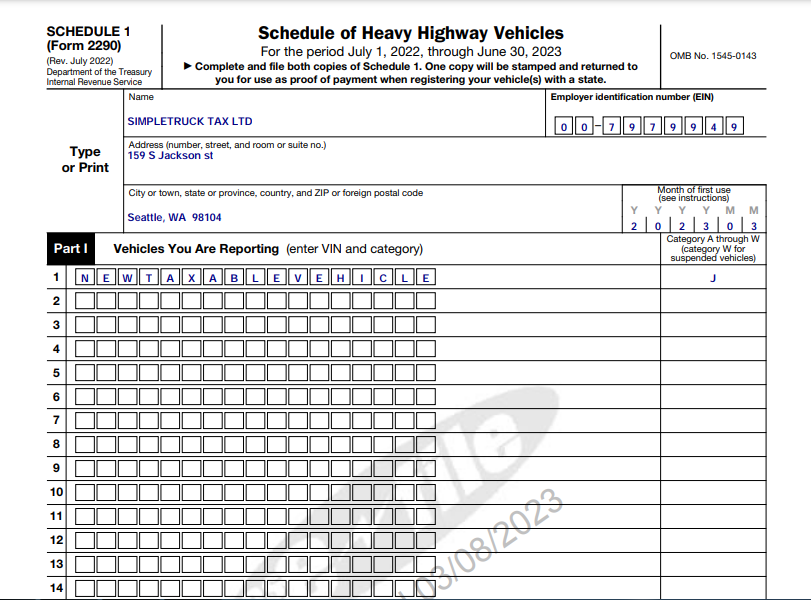

Get StartedForm 2290, also known as the Heavy Highway Vehicle Use Tax Return (HVUT), is filed by owners of heavy vehicles weighing 55,000 pounds or more.

Read MoreThe due date for filing Form 2290 is typically August 31st of each year for the upcoming tax period, which runs from July 1st to June 30th.

Read MoreThe Form 2290 instructions provide guidance on how to complete and file the Heavy Highway Vehicle Use Tax Return.

Read Moresimple truck tax

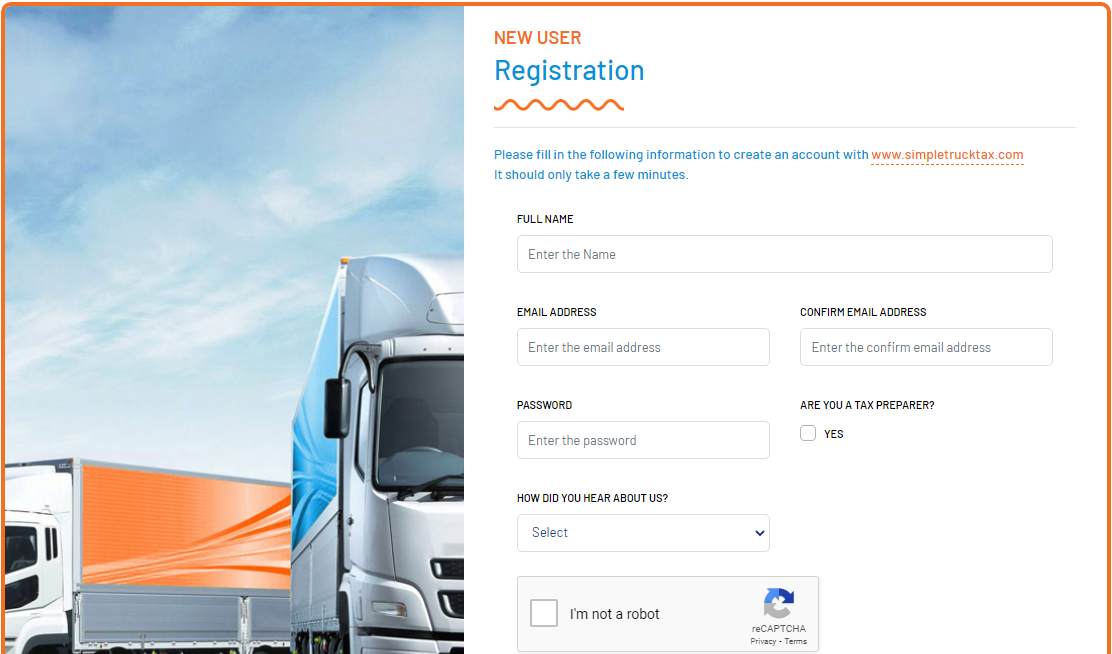

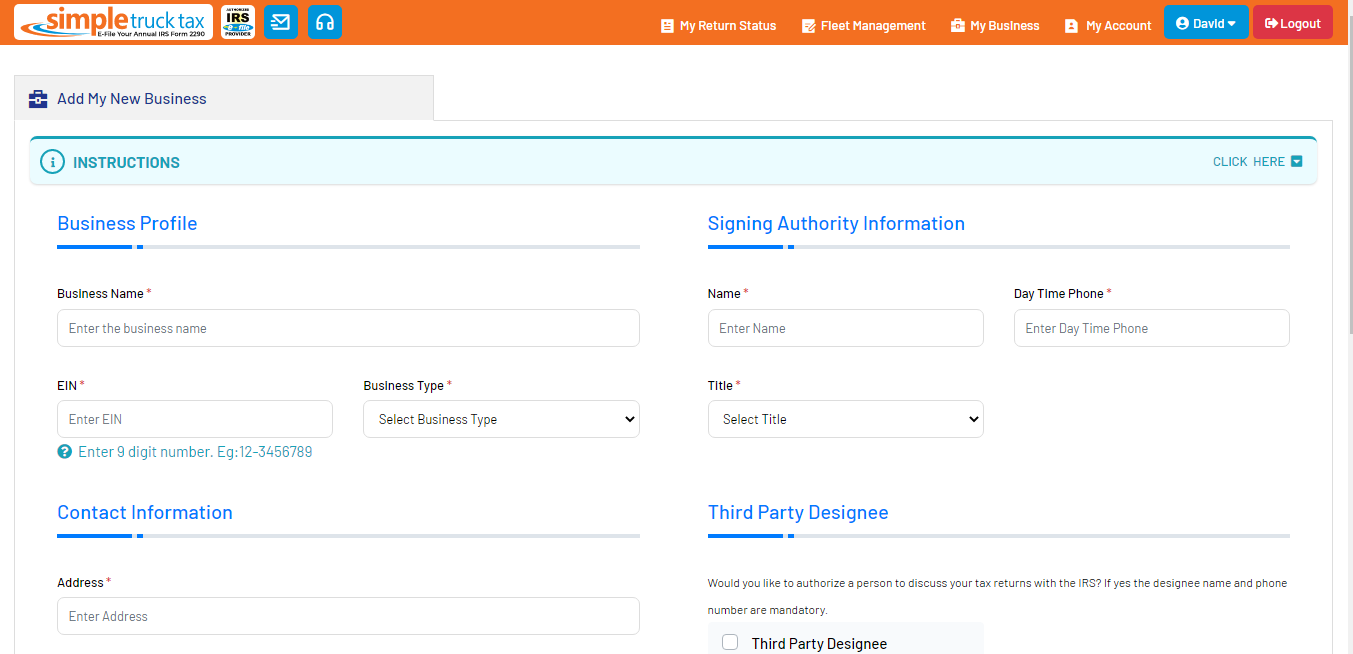

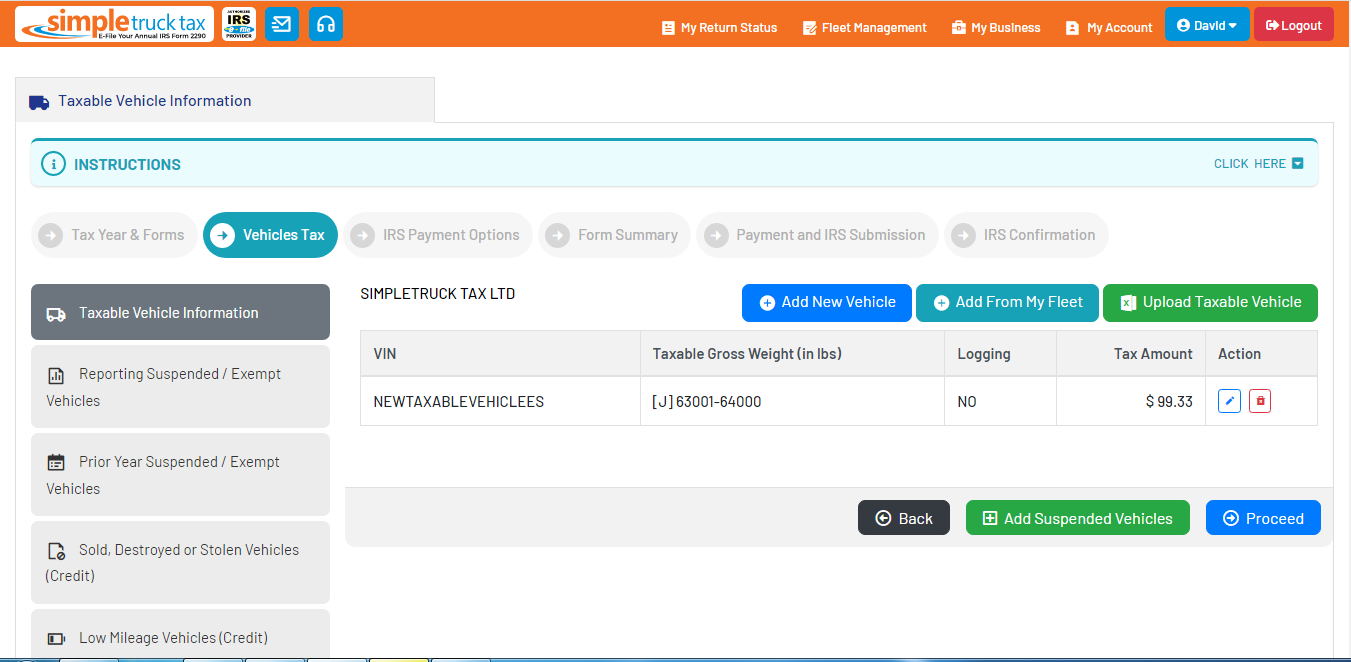

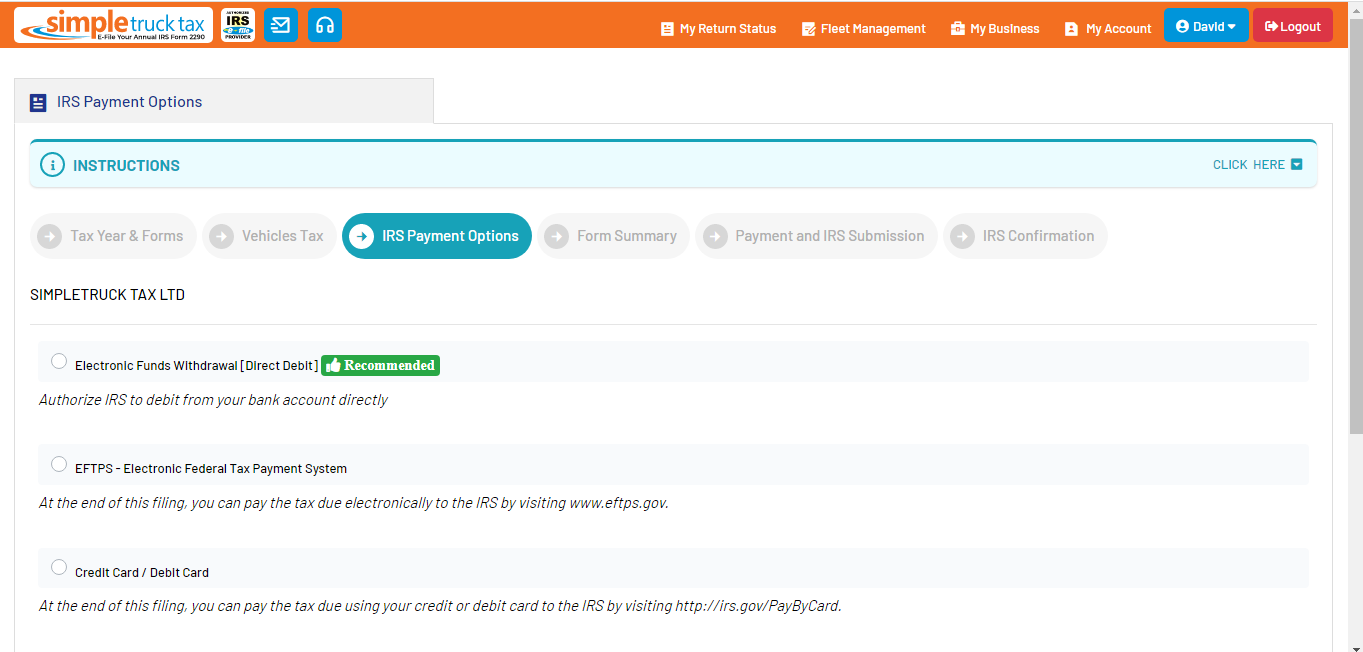

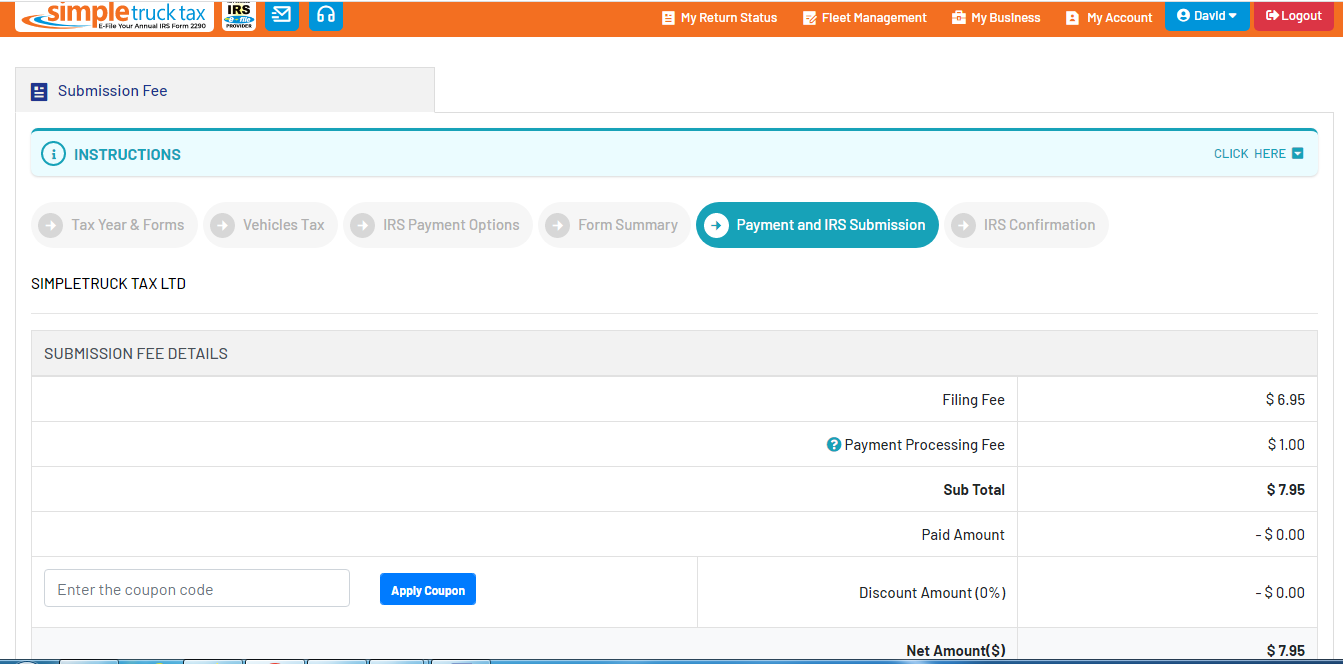

Use SimpleTruckTax's simple user interface to enter all your information. This step should take less than 5 minutes if you have all your information handy. Get your IRS Stamped Schedule 1 in less than a minute!

In this helpful video, we will walk you through the process of e-filing Form 2290. E-filing your Form 2290 has many benefits, including convenience, speed, and accuracy. By following the steps outlined in this video, you will be able to file your form quickly and easily.By following these step-by-step instructions, you will be able to complete your Form 2290 e-filing with ease. Say goodbye to the hassle of paper forms and enjoy the convenience of e-filing. Also you can download our first time e-filing guide here.

Calculate and pay tax for highway vehicles with a gross weight of 55,000 pounds or more.

Pay tax for vehicles that exceeded mileage use limit after suspension statement completion.

Adjust tax for vehicles whose weight increased during the period.

Request tax suspension for vehicles used 5,000 miles or less

Receive credit for tax paid on vehicles destroyed, stolen, sold, or used minimally.

Report acquisition of a used taxable vehicle with suspended tax

Calculate and pay tax for used taxable vehicles acquired and used during the period.

Request tax suspension for vehicles used 7,500 miles or less for agricultural vehicles.

Receive credit for tax paid on vehicles used 7,500 miles or less for agricultural vehicles

Simple Truck Tax

Latest Updates