Form 2290

As a trucker, you know that filing Form 2290 is an essential part of your job. But what happens if you make a mistake on the form, such as entering an incorrect Vehicle Identification Number (VIN)? The good news is that you can correct this mistake by filing a Form 2290 VIN correction. In this blog, we'll take a closer look at what a Form 2290 VIN correction is, how to file it, and when it needs to be filed.

Form 2290 VIN correction is used to correct any errors made on a previously filed Form 2290, specifically errors related to the Vehicle Identification Number (VIN). A VIN correction is necessary if you made an error when entering the VIN for a vehicle, as the IRS uses the VIN to identify and track the vehicle for tax purposes.

To file a Form 2290 VIN correction, you need to complete Form 2290 again with the corrected VIN and check the box indicating that it is a VIN correction. You also need to provide the original filing date and the vehicle identification number that was originally reported. The corrected form can be filed electronically or by mail, along with any additional payment due.

You should file a Form 2290 VIN correction as soon as possible after you realize you've made an error on the original form. If the correction is not made, it could result in penalties or fines for incorrect reporting of tax liabilities. In addition, a VIN correction is necessary if you need to transfer a vehicle title, as the DMV requires proof that the VIN has been corrected on Form 2290 before issuing a new title.

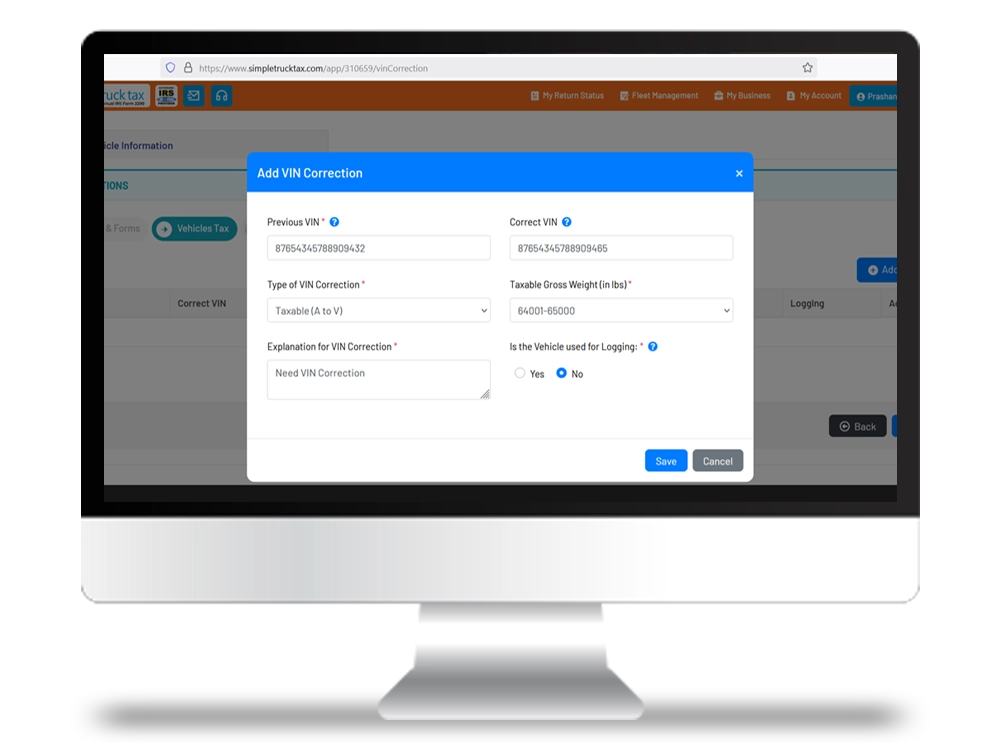

Making corrections to your VIN is easy, simple, and hassle-free by Simple Truck Tax. Suppose that you have made an error in your Vehicle Identification Number when filing Form 2290. Our platform allows you to make the correction in just a few easy steps. With user-friendly navigation, instant confirmation of your filings, and expert support, you can correct mistakes at no cost to you, ensuring compliance and avoiding penalties. Trust Simple Truck Tax for accurate and efficient VIN corrections!

A Form 2290 VIN correction is important to ensure that the IRS has accurate information about your vehicle and tax liabilities. If you've made an error on your Form 2290, don't panic - simply file a VIN correction as soon as possible to avoid any penalties or fines.

Simple Truck Tax

Are you in need of assistance in e-filing? Do not worry, our multilingual customer support team is here to help you step by step. From having questions to needing guidance, we are just a call or message away to make your filing process smooth and hassle-free!

The assistance provided was beyond expectations. This was my first time doing it, and their support stayed with me until everything was completed. It took me longer because I was multitasking and they waited whileI was getting other things done. Thank you! The best service I have ever received from any phone support.

I've been with them for just under a year. They are good people who conduct business in a professional manner. they stay on top of trending news in the trucking industry and use that knowledge to better serve their customers. I like the family atmosphere and the first-name basis. pricing for services is lower than the industry standard , I think I'll stay right here.

I have been using Simple Truck Tax for six years now to file our yearly 2290. It is simple to use, and they file it quickly. I have a login, and it is easy to add and remove trucks. They remember my information, so I don't have to upload it again the following year. I definitely recommend their 2290 service.