Form 8849

With Simple Truck Tax, filing your IRS Form 8849 Schedule 6 refund is easy and straightforward. It provides truckers with a way to request refunds for overpaid taxes or for situations such as low mileage, sold or destroyed vehicles. Using our intuitive interface, you can quickly and accurately file your refund request.

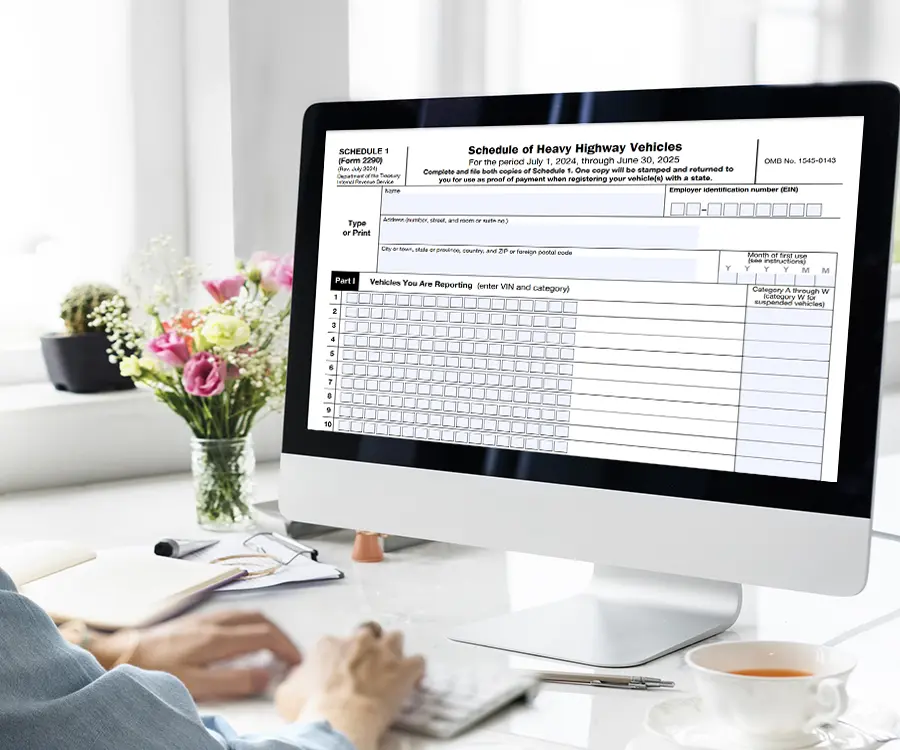

Start e-Filing Form 2290 Now!

Step 1

Log in to Simple Truck Tax and choose Form 8849 Schedule 6.

Step 2

Enter your information, including the reason for the refund.

Step 3

Upload any documents required to support your claim.

Step 4

Review and submit the form electronically.

Step 5

Wait for IRS update or contact IRS

Simple Truck Tax

Are you in need of assistance in e-filing? Do not worry, our multilingual customer support team is here to help you step by step. From having questions to needing guidance, we are just a call or message away to make your filing process smooth and hassle-free!

The assistance provided was beyond expectations. This was my first time doing it, and their support stayed with me until everything was completed. It took me longer because I was multitasking and they waited whileI was getting other things done. Thank you! The best service I have ever received from any phone support.

I've been with them for just under a year. They are good people who conduct business in a professional manner. they stay on top of trending news in the trucking industry and use that knowledge to better serve their customers. I like the family atmosphere and the first-name basis. pricing for services is lower than the industry standard , I think I'll stay right here.

I've been using them for years to file heavy highway use tax. Very simple and inexpensive. And they keep equipment information on file until I delete it, so I don't have to re-enter info each year.Very much worth the time and hassle saved by not going to the IRS office to file...

I have been using Simple Truck Tax for six years now to file our yearly 2290. It is simple to use, and they file it quickly. I have a login, and it is easy to add and remove trucks. They remember my information, so I don’t have to upload it again the following year. I definitely recommend their 2290 service.

I like many features of the software. It is simple to use and provides a fast return. I got my Schedule 1 quickly.

I'm paying highway tax through them and have never had any issues. I called customer service once, and the representative super nice and helpful.