Trusted by 100,000+ CPAs across the United States!

Form 2290

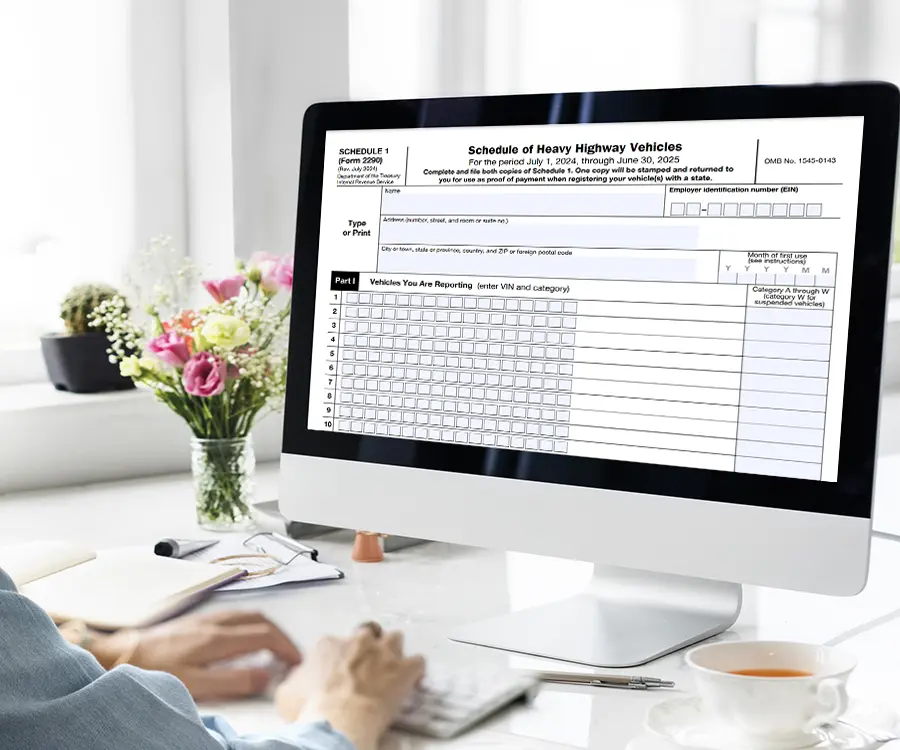

Quickly and easily file Form 2290 e-file with our IRS authorized platform. Avoid paper hassles and file from the the comfort of your home or office and save time. Our user-friendly interface guarantees an easy and smooth process for filing even for the first-time user, with step-by-step instructions tailored to individual requirements. At just $9.95 per filing, we are one of the most affordable solutions for truckers and fleet operators to get their IRS Schedule 1 in minutes. Experience fast, secure, and accurate e-filing today and keep your business rolling without interruptions!

Start e-Filing Form 2290 Now!

Take just a few minutes with our online smooth filing process and get Form 2290 submitted quickly right from the comfort of your home or office.

Affordable pricing with our best-valued competitive rates at $9.95 to file.

File multiple 2290 forms at the same time.

Receive your IRS Schedule 1 instantly after successful filing, avoiding delays.

is available at every step to guide you further in your needs.

Your data will be protected by advanced encryption to guarantee a safe filing experience.

Simple Truck Tax

Are you in need of assistance in e-filing? Do not worry, our multilingual customer support team is here to help you step by step. From having questions to needing guidance, we are just a call or message away to make your filing process smooth and hassle-free!

The most common error on Form 2290 is incorrect vehicle details, such as the VIN, taxable gross weight, and first use month. Double-check all vehicle information before submitting the form to ensure accuracy.

Get guaranteed IRS Schedule 1 in minutes(if your info matches the IRS database). E-file Form 2290 with us today - our fast and secure processing ensures a hassle-free way to get instant confirmation, putting you back on the right side of the road within no time.

Always, the tax year is from July 1 to June 30. The Form 2290 due date is based on the month that your truck first used public highways during the tax period. Trucks used in July will be required to submit their return by August 31. In other months, the due date will be the last day of the following month.

Frequently Asked Questions?

eFiling Form 2290

The assistance provided was beyond expectations. This was my first time doing it, and their support stayed with me until everything was completed. It took me longer because I was multitasking and they waited whileI was getting other things done. Thank you! The best service I have ever received from any phone support.

I've been with them for just under a year. They are good people who conduct business in a professional manner. they stay on top of trending news in the trucking industry and use that knowledge to better serve their customers. I like the family atmosphere and the first-name basis. pricing for services is lower than the industry standard , I think I'll stay right here.

I have been using Simple Truck Tax for six years now to file our yearly 2290. It is simple to use, and they file it quickly. I have a login, and it is easy to add and remove trucks. They remember my information, so I don't have to upload it again the following year. I definitely recommend their 2290 service.